I LIKE TO BE POSITIVE. As your treasurer, I love to stand before you and report on how well we’re doing financially. As you know, the road has been a bit rocky the last few years. So, the financial results for 2021 definitely show improvement. But they are not up to the level that we are capable. I know that we can and will do better.

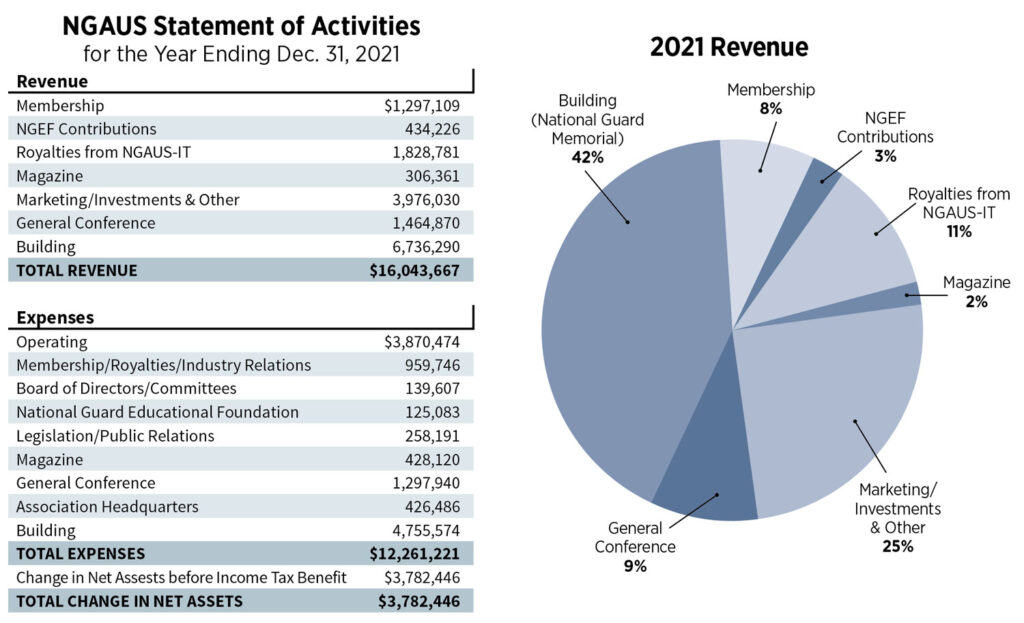

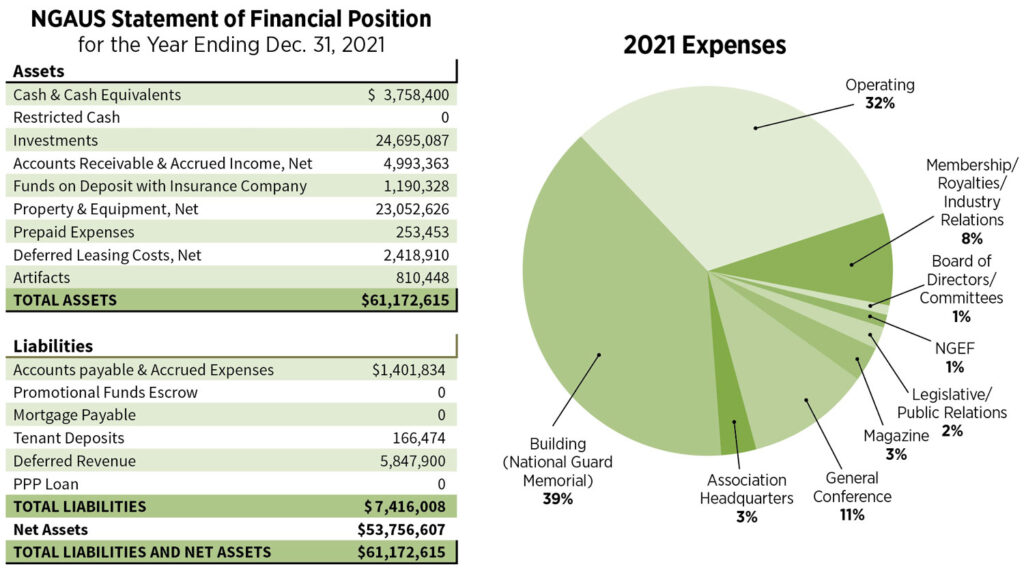

Let me start by reviewing our largest cash-flow revenue source as determined by the annual audit. For discussion purposes, let me list them in order of approximate revenue provided by each program in 2021, largest to smallest.

I am netting revenue minus the expenses for each of these operational programs.

Our building provided our largest cash-flow contribution last year. It provided more than $2.25 million dollars in net cash flow. Next was the Insurance Trust, which contributed over $1.3 million in cash flow, a very good year for this program. The third most important program last year was our dues collection, netting a little more than $750,000 (dues collected less rebates to our state partners).

Finishing out the list of our largest cash contributing programs was the net proceeds from our annual conference and exhibition. This totaled a little more than $165,000. Overall, building rentals and the insurance program did well, in line with our long-term average. But our dues program and especially our conference exhibition program were lower than our expectations.

There is good news going forward on the exhibition and membership fronts. Exhibit sales for the 144th Conference & Exhibition in Columbus, Ohio, this year exceeded out ambitious goals. We expect more than 340 companies or organizations, the highest in more than a decade. Additionally, membership is showing some growth, which provides both revenue and helps fuel of our message on Capitol Hill.

Your staff and board of directors are working hard to continue to make improvements in these areas, which is why I say we will do better.

Financial Reserves

A cash flow analysis of our NGAUS operational programs taken together show that we netted just over $2 million in cash-flow profits. As always, these net cash gains go into our reserves until those requirements have been fully met. That is how we remain financially sound. So, I’m going to take a moment to comment on our reserve requirements and where we stand with those.

NGAUS is a very large business operation that is planning to be around forever and to be prepared for any financial challenges that might come our way. Our business, like so many others, has business cycles that span several years. A great example is our headquarters building. It has a tenant turnover and rebuilding cycle of about 10 to 12 years. The cost of releasing and rebuilding our tenant spaces can be as much as $15 million of required cash on hand.

If you add in the requirements for reserves for our other programs and our life-dues stabilization reserves, our total reserve requirement is about $30 million. An analysis of where we stand today in having the required reserves on hand shows that we need to add an average of $2.25 million per year to our reserves over the next eight years.

That number of years is determined by where we are in our long-term business cycle, and this is driven primarily by the building-rental business cycle

So, 2021 was a bit short of the cash flow profits that I would like to see. All this analysis is based on cash flow without considering gains or losses in our reserve accounts. That is because those gains and losses are for the most part only on paper until you actually sell those investments. And we certainly all know that those values go up and down, and we should not be counting on those investment values until we actually need to sell them to fund our operations.

I know I’ve provided lots of numbers, and about now some of you probably want to ask, “Are we OK?” At the moment, we are fine. Of that $30 million in reserve requirements, we currently have about $12.5 million. And as I’ve said, we had about eight years to replenish the balances. I am confident that we can accomplish this goal. But while we are fine, we are not “fat.”

In fact, a better description of our current condition is that we are a bit lean. I’m concerned that some member think we have more money than we could possibly need and that we should be looking for ways to spend more money. The lesson of the last few years is that hard times do come along, and we need to be prepared.

We made it through the last few years because we were prepared to sustain the losses such as 2017 and 2020 by maintaining adequate reserves. We should be able to maintain our current operations and get back on track as set forth above providing we continue to improve our revenue sources and not allow our expenses to grow.

As I have said many times in the past, your board of directors and staff has adopted a great business plan and we will continue to fund all of our valuable programs while sharing as much as possible with our stakeholders and keeping our expenses as low as possible. We are one of the premier military membership organizations in the United States, and we’re going to make sure that we are financially secure, providing the benchmark for others to follow.

2021 Financial Report

This report would not be complete without noting another “clean” outside audit. At the close of last year, the independent accounting firm of Thompson, Greenspon CPAs & Advisors of Fairfax, Virginia, audited our association’s books. The NGAUS and Affiliates 2020 State of Financial Position on page 59 reflects the audited and approved financial information.

As always, I want to take this opportunity to thank the people who do the real work in making us one of the strongest associations in the nation’s capital.

The first is the association’s finance committee, which includes top-notch financial professionals who volunteer their time and expertise to make sure our association stays on track. It is chaired by retired Maj. Gen. James Hoyer of West Virginia. The former NGAUS chairman is joined by one member from each of the six NGAUS areas: Col. George Harrington of Massachusetts (Area I), Lt. Col. Evert Hawk of Maryland (Area II), retired Col. James Wells of Tennessee (Area III) retired Brig. Gen. Ed Giering of Louisiana (Area IV) and Lt. Col. Gene Whitmore of Utah (Area VI). Area V currently has a vacancy. Maj. Gen. Janson “Durr” Boyles of Mississippi, the NGAUS chairman, and retired Lt. Col. Peter Renaghan of Massachusetts, the former chairman, are also on the committee.

Our association’s financial health also would not be possible without the dedication of the NGAUS staff. It’s led by retired Brig. Gen. J. Roy Robinson, the association president, retired Col. Paul Drake, the chief of staff, and Cheryl Young, the finance director. Her finance team includes comptroller Laurence Temple and staff accountants Lacey Morse and Kendra Robinson.

Thank you for trusting me to be your treasurer and to work with all these great people to make sure that NGAUS remains strong. Our members and our nation need us to continue our role to educate our nation’s leaders on the importance of our nation’s National Guard. It is truly a national treasure.

House Republicans to SECDEF Reconsider Vaccine Mandate

WASHINGTONUPDATE The latest Capitol Hill news from the NGAUS legislative staff Fifty-one House Republicans have asked Defense Secretary Lloyd J. Austin III to reconsider the

President Signs ‘Burn Pit’ Law; VA Establishes Online Info Site

WASHINGTONUPDATE The latest Capitol Hill news from the NGAUS legislative staff President Joe Biden signed into law Aug. 10 last week the Sgt. First Class

Guard Bureau Releases New ARNG, ANG Seals

NEWSBREAKS The National Guard Bureau has unveiled revised seals for the Army National Guard and a first one for the Air National Guard, according to